From the Archives: April 9, 2019

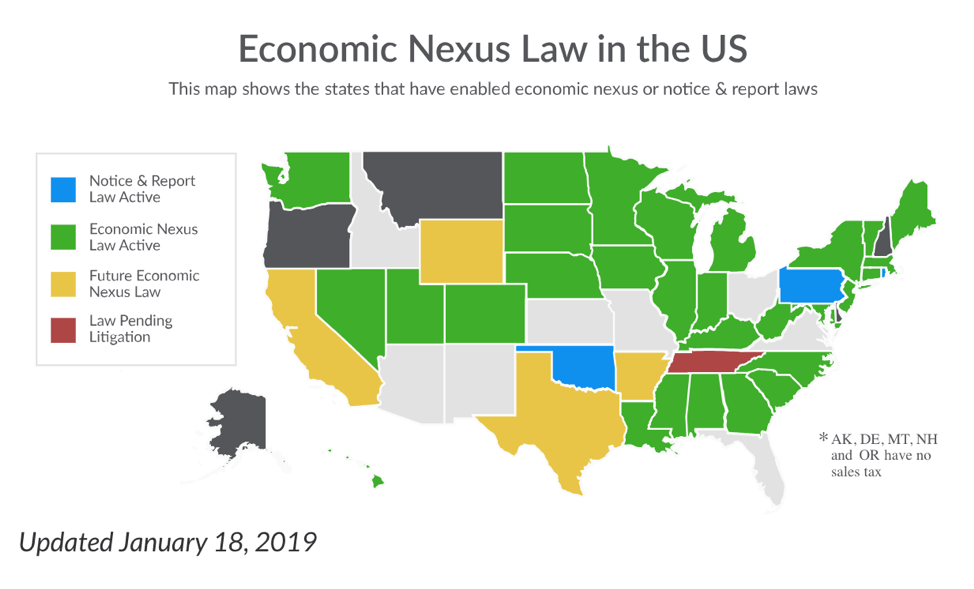

Confusion has been the consistent word whenever we speak of regulations and how they are interpreted and applied to the ecommerce retailer. Usually we are discussing the FDA or FTC impact on regulatory compliance, but now we can add taxation and each State’s opinion of same to the discussion. In June 2018, the Supreme Court case South Dakota v. Wayfair decidedly made the e-commerce dietary supplement sellers’ obligation toward regulatory compliance even more confusing and onerous. For decades, the e-commerce world enjoyed a type of discount not shared by their brick and mortar retail counterparts. The previously recognized 1992 decision, Quill Corp v. North Dakota, supported the sales tax exemption, which set the property or employees standard for sales taxes using the Court’s commerce clause power to restrict state sales taxation of interstate commerce. “Nexus” became a term that targeted many e-commerce retailers, whether they did business with large e-tailers such as Amazon or direct to consumers. The term nexus was previously defined as having a physical presence in a state. Now you are required to collect sales tax in states where there is sales tax nexus and product taxability. This taxblog.com chart indicates the number of states that now have economic nexus.

There are several ways to have sales tax nexus in different states:

- A location: an office, warehouse, store, or other physical presence of business.

- Personnel: an employee, contractor, salesperson, installer or other person doing work for your business.

- Affiliates: Someone who advertises your products in exchange for a cut of the profits creates nexus in many states.

- A drop shipping relationship: If you have a 3rd party ship to your buyers, you may create nexus.

- Selling products at a trade show or other event: Some states consider you to have nexus even if you only sell there temporarily.

- Inventory: Most states consider storing inventory for sale in the state to cause nexus, even if you have no other place of business or personnel.

Most Amazon retailers were previously able to escape state sales tax issues because of the lack of location or personnel in the state, which would require sales tax collection. By including the inventory requirement for the establishment of state sales tax, compliance becomes exponentially more difficult. Even if your company only sells to “Amazon”, the reality is that the location of the distribution facilities establishes an inventory consideration. Amazon now has fulfillment centers in these states:

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nevada

- New Hampshire

- New Jersey

- North Carolina

- Ohio

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

Not all products are sold into all fulfillment centers consistently, but the requirement is established when they do. There are economic considerations in each state that may make the obligation unnecessary, but the requirements must be considered in each state that collects sales tax. Only Alaska, Delaware, Montana, New Hampshire, and Oregon do not have sales tax, so no concern for reporting exists. In all other states, the laws and regulations for filing must be monitored and followed to avoid fines and penalties. While the FDA considers dietary supplements a food, state sales tax regulations routinely do not and usually tax the products more like they tax tobacco and alcohol.

The tax rates charged vary from state to state. Kansas does not tax dietary supplements if they are sold with a prescription. Illinois taxes dietary supplements in the same classification as drugs at a 1% rate.

When the consumer is shopping on Amazon, they can see what the estimated sales tax will be and use that information to determine their final price, just like in a brick and mortar counterpart. But only if the counterpart has this sign in place, as is the case on Amazon, as found at (Amazon.com Help: About Tax):

How Tax is calculated:

The amount of tax charged on your order depends on many factors, including the following:

- The identity of the seller

- The type of item or service purchased

- The time and location of fulfillment

- The shipment or delivery address of your order

These factors can change between the time you place an order and when your shipment is complete. As a result, the tax calculated on your order may change. We provide an “Estimated Tax” is displayed at Check Out when confirming an order. The amounts displayed as estimated tax may then be updated later when your order is finalized and completed.

Also, Amazon was touted for deciding to collect sales tax where applicable. But there’s a big loophole — shoppers don’t have to pay sales tax when they buy from one of the site’s many third-party vendors. This loophole creates an estimated loss of tens of millions of dollars of state sales tax, since the vast majority of Amazon sales flow through these 3rd party sellers. This brings us back to the responsibility that rests on sellers to maintain the regulatory compliance requirements, regardless of how confusing they may be.

~Scott

0 comments