From the Archives: April 4, 2018

While Amazon began by selling books, the impact the corporation has on the economic market now affects almost every consumer and business segment in some capacity. Amazon sells diapers and coffins and just about everything one can want in between. If Amazon doesn’t sell it now, it is rumored they’ll start soon, as is the case with pharmaceuticals. On April 2, 2018, the Dow Jones Industrial Average dropped almost 500 points and almost 3.5% on the concern a trade war with China would have with Amazon. Amazon’s influence on the world economy is undisputed.

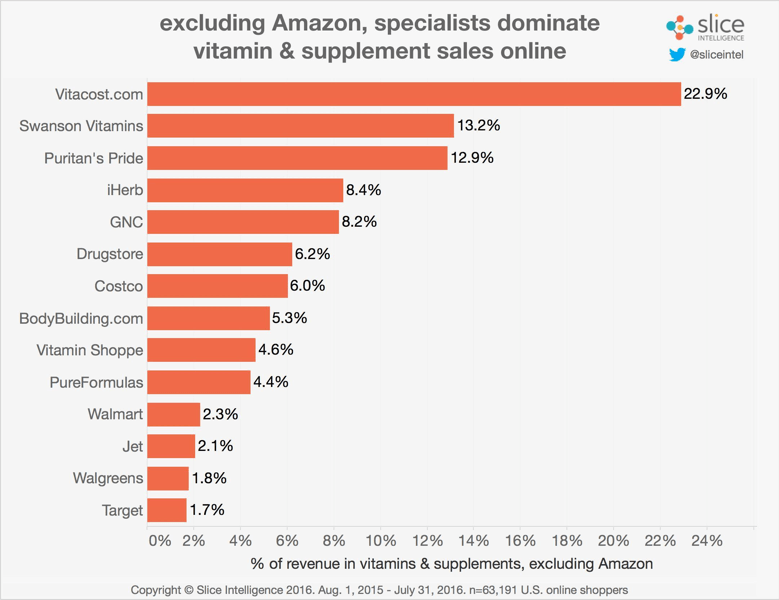

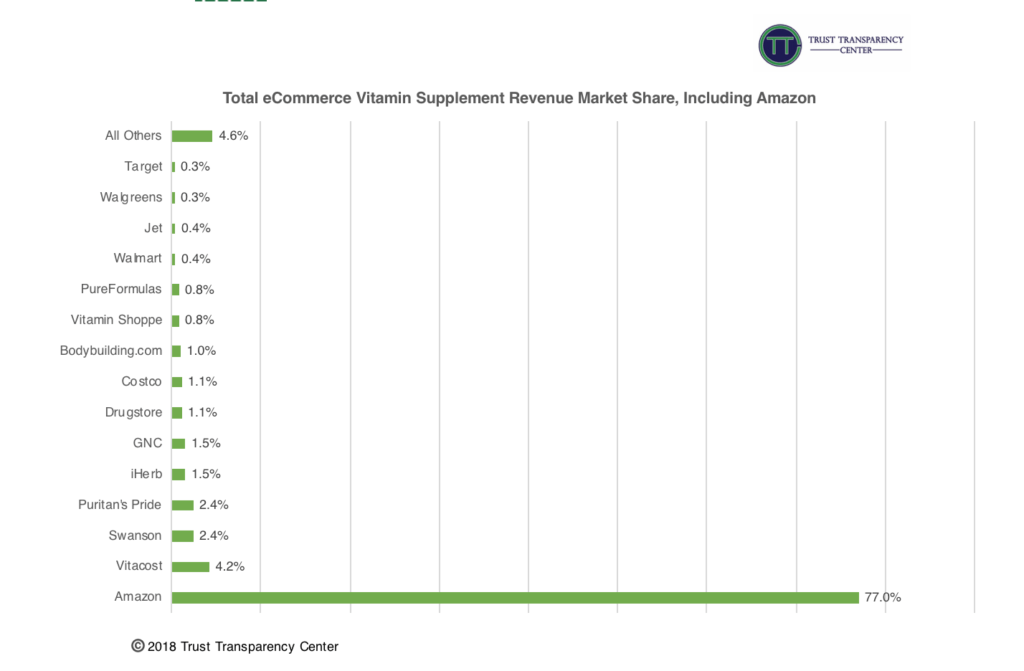

Amazon’s influence on the supplement industry has become even more impactful as the rate at which the giant is gobbling market share is unprecedented and seems to be without constraint. A recent report from Slice Intelligence indicates the vitamin and supplement category is outpacing other e-commerce categories. This same Slice report indicates U.S. vitamin and supplement e-commerce sales grew 40% in 2016 and at a 12 percent faster rate than the general e-commerce market. According to a 2017 Slice Intelligence survey of U.S. shoppers, Amazon accounts for 77% of all U.S. vitamin and supplement sales made online. The remainder of the vitamin and supplement e-commerce sales are almost entirely divided by vitamin and supplement specialized sellers such as VitaCost, Swanson, Puritan’s Pride and iHerb. The two largest brick and mortar vitamin and supplement retailers, GNC and Vitamin Shoppe, combined receive approximately 2.3% of the total e-commerce market in their category, further underscoring the emergence and impact of the Amazon effect.

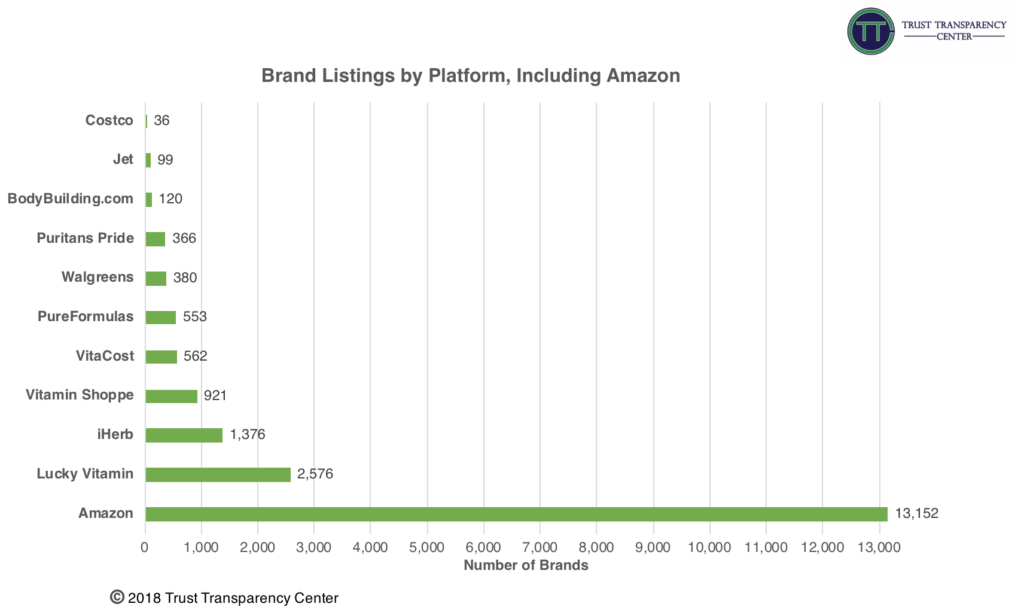

Another aspect of the Amazon effect is the product offering the providers carry. The more involved the platform vetting process, logically, the fewer brands are offered. Amazon is the demonstrated leader in the market offerings with over 13,000. The range of brands being carried among those platforms that promote multiple brands is 36 to 13,152.

Platforms that responded to our request for details on their onboarding process mentioned or provided a vetting process. Amazon directed us to a terms and conditions page specifying the 5 requirements to sell dietary supplements on Amazon: Amazon Seller Central Dietary Supplements

These are:

-

- Name of the dietary supplement

-

- The net quantity or amount of the dietary supplement

-

- Nutrition labeling

-

- The ingredient list

-

- The name and place of business of the manufacturer, packer, or distributor

Additionally, Amazon commented:

“According to our Terms & Conditions, which are valid for all third-party sellers selling on Amazon, it is not allowed to offer products that are violating legal provisions. If we get notified about specific products, we will immediately review and, if confirmed, remove items as well as approach our sellers to secure compliance with our T&Cs.”

Included on the Terms and Conditions included on the Seller Central Page is a listing of 23 prohibited listing categories and a list of banned products and ingredients numbering 1,391. Product names on the list include a ‘hall of shame’ of FDA blocked ingredients and products including Ephedra, steroids, and Sibutramine. One curious note on the “prohibited” products listing was the inclusion of a handful of Walmart Spring Valley and Walgreens products including Echinacea, St. John’s Wort, Garlic, Ginkgo Biloba, and Saw Palmetto. All of the Walmart Spring Valley and Walgreens banned ingredients are sold by other brands including Nature’s Bounty, the manufacturer of Walmart Spring Valley products.

It is clear Amazon has some vetting criteria but it is inconsistent and completely reactive to some undefined impetus from the marketplace. A responsible vetting process would be both proactive and well-defined. It is that vetting process Trust Transparency Center seeks to assist the e-commerce segment of the industry to implement. Stay tuned to this site for more information on this topic.

The Amazon Effect is immense across all areas of the U.S. marketplace, and it is especially impactful on the U.S. dietary supplement market. The likelihood this effect will diminish any time soon is not high but it is important that we continue to monitor the impact on the industry. Trust Transparency Center is committed to keeping a watchful eye on all effects in the marketplace that cause us nervousness, including the Amazon Effect. We will continue to maintain our vigilance. See you next Tuesday for our next Trust Talk!

~Scott

0 comments